Curves can be generated from component rates. For example a zero discount curve can be generated from a combination of deposit and swap rates, futures and cap volatilities.

The curve is segmented into intervals of varying maturity. Different instruments are used within these segments to construct the curve from the short to long end. The overall controlling function is called the bootstrapping method.

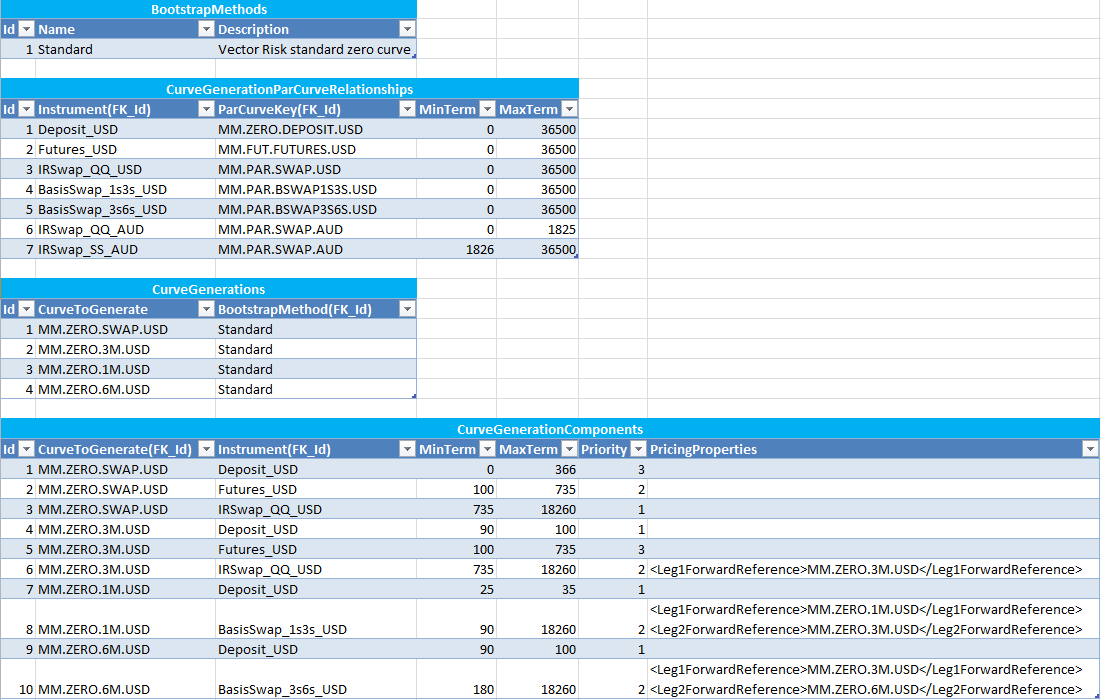

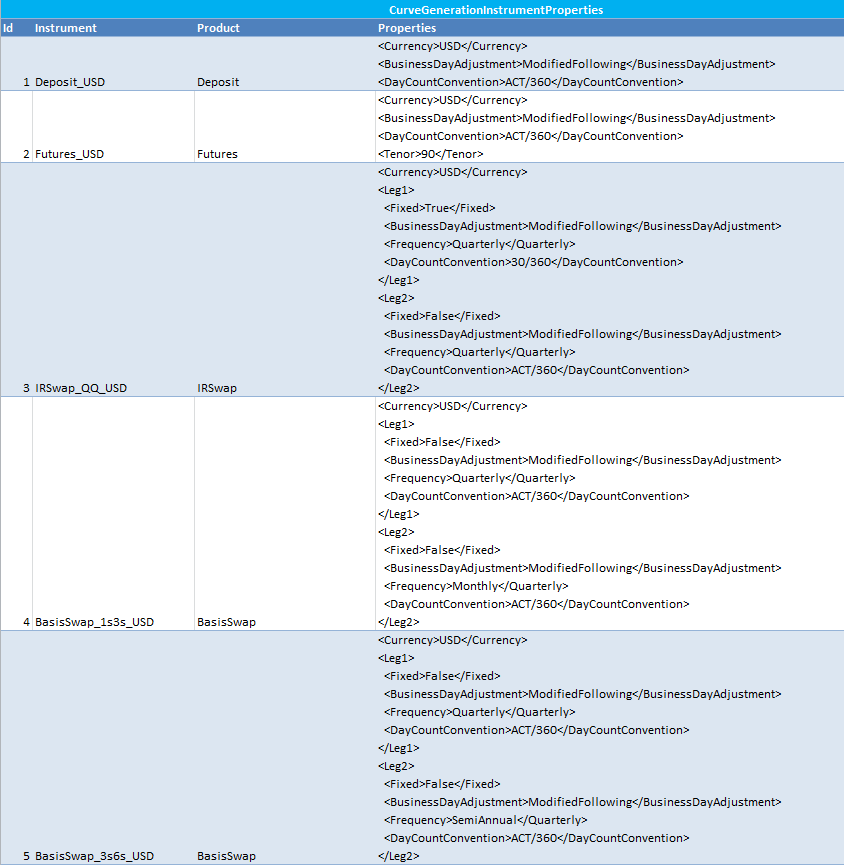

Vector Risk has a "standard" method for building zero curves out of any combination of cash, futures, caps and swaps. An example of the inputs for building a USD zero curve is shown below.

Other bootstrapping methods can be defined and added to the Vector Risk engine. It is possible to set up a daily process that includes generating curves from par rates as a pre-cursor to using the curves in simulations.

Sample Definition