Step 1: Calculation of the Average 6 month Gross Flow Rates and Recovery Rate

- Compute gross flow rates for preceding 6 months using historic month end receivables.

- Gross flow rates reflect the percentage of receivables in each cycle which have migrated from the previous cycle over the course of one month:

Eg Cycle 1 to Cycle 2 Gross Flow Rate = (This month cycle 2 balances) / (Last month cycle 1 balances)

- Gross flow rate from Cycle 6 to contractual write off should be against principal contractual write off only and excludes any interest element.

- Compute the average rates for the past 6 months gross flow rates.

- Compute the average recovery rate using total amount recovered over total contractual gross write-offs over the past 6 months.

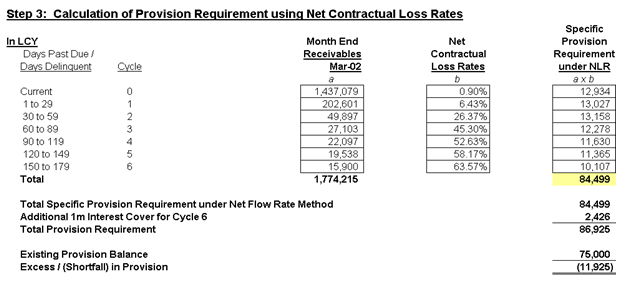

Step 2: Calculation of the Net Contractual Loss Rates

- The net contractual loss is defined as the principal write-offs projected to occur at Cycle 7 delinquency (180 days past due) less estimated recovery. Write-offs for pre-180 days past due accounts are excluded.

- The gross contractual loss rate for a cycle can be estimated by multiplying all the average flow rates starting from that Cycle up to Cycle 6. This reflects the probability of write off for that cycle.

- The gross contractual loss rates are then discounted by the average 6 months recovery rate to arrive at the net contractual loss rates.

- The average 6 months gross flow rates and average recovery rate as computed in Step 1 above should be used to calculate the net contractual loss rates.

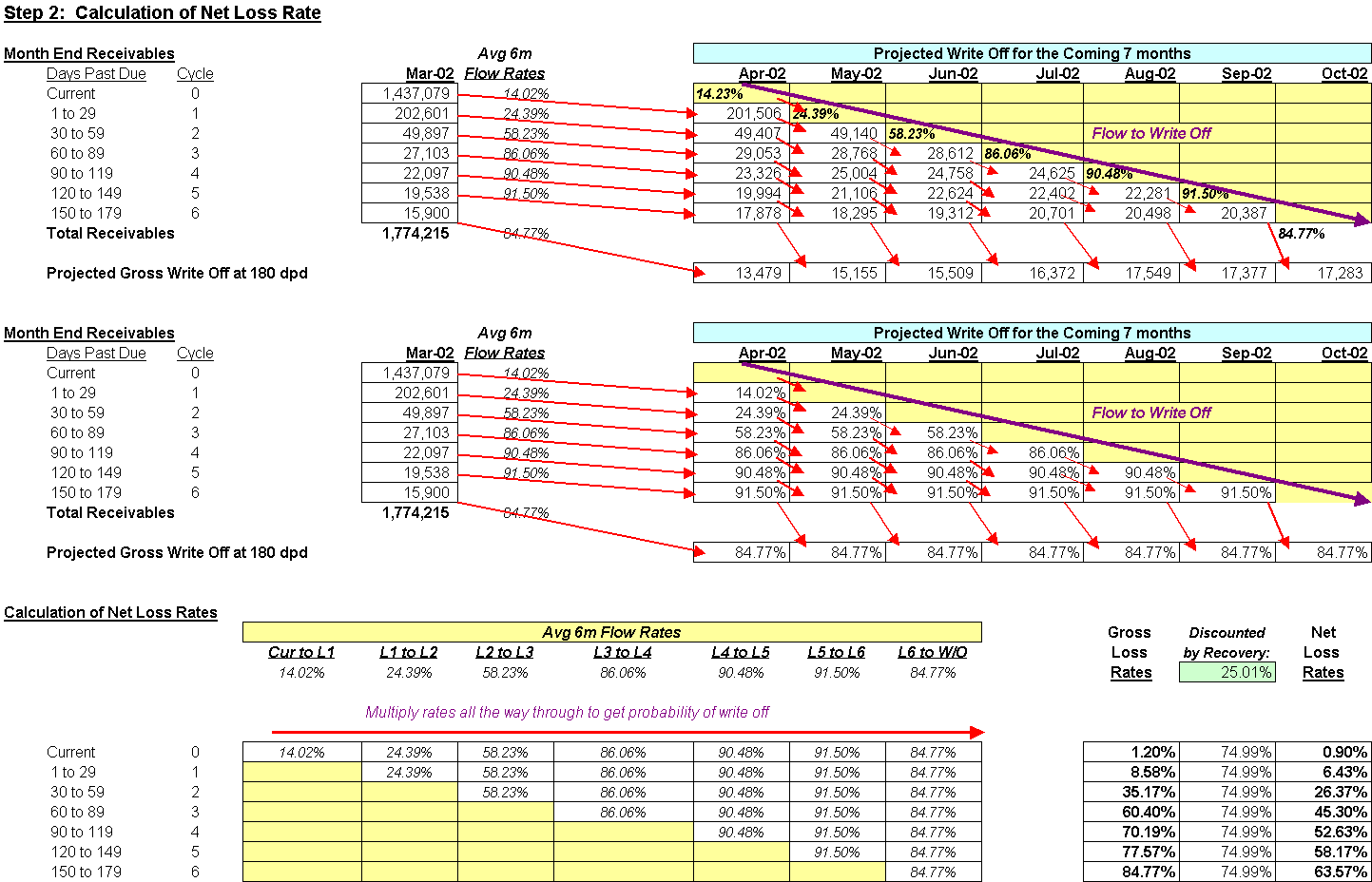

Step 3: Calculation of Total Specific Provision Requirement

- Apply the computed net contractual loss rates to the latest month end receivables (as indicated below) to compute the specific provision requirement under NFR.

- Where interest is only suspended at 180 days past due, an additional specific provision should be raised to provide cover for interest on accounts that are 4 or more cycles delinquent. For expediency, the additional specific provision to be raised on interest should be equal to the amount of interest held at bucket 6. The amount should be added to the overall provision requirement.