This measure explains the changes to a portfolio of trades between two dates, typically yesterday and today although any time frame can be chosen.

All trades have a unique identifier (source system & source id). These identifiers are used to figure out which trades are ongoing (in both sets) and which trades are matured/closed out in the first set, or new in the second set. From there we can calculate the following sources of change:

| Source of Change | Description |

| Theta | The change in value on ongoing trades due to time decay |

| Cashflow | The change in value on ongoing trades due to cashflow events between the two dates. |

| Market Rates | Change due to market rates. This applies to ongoing trades only. The results are able to be broken down to risk attributions of your choice, similar to how attributions are specified for Var. |

| Maturing Trades | Change due to maturity/close out of trades (those existing in the first trade set but not the second). |

| New Trades | Mark to market of new trades (those existing in the second set but not the first). This result can highlight profitable trades or off-market trading. |

| Position | The change in value of ongoing trades due to trade amendments or cashflow resets, or mtm value of a change in the size of an exchange traded position. |

| Balancing Item | The leftover difference between the two portfolio valuations not explained by the above sources. Small balancing items can be caused by second order effects. If the balancing item is large it is possible to drill down to P&L attribution results at a trade level. |

The configuration files that affect P&L attribution are:

| Configuration File | Details |

| TaskList | The Decomposition task type is used to run decomposition calculations. |

| Assumptions | Base assumptions common to all calculations. |

| BusinessUnits | The books that trades are attached to and the relationships required to aggregate results at intermediate and total levels. |

| DecompositionDefinitions | Includes the attribution definitions for further dissecting the change in value due to market rate movements. |

| DecompositionCalculations | Specifies the business unit for which the decomposition calculation is performed as well as the definition to use (def ID) and the reporting currency. |

Viewing Results of a Decomposition Calculation

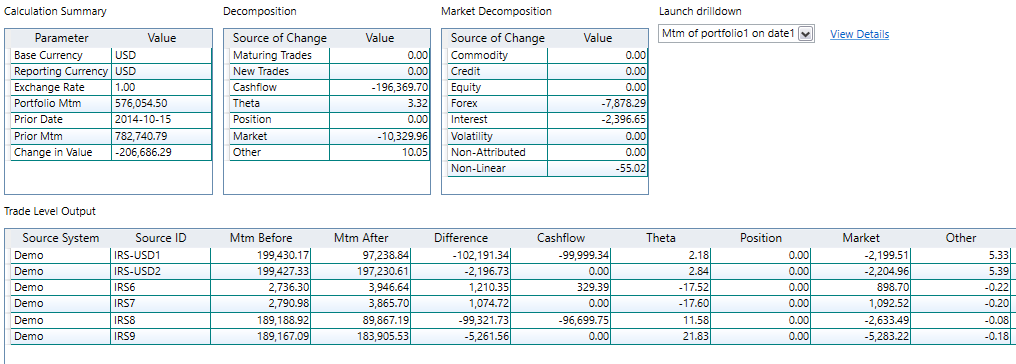

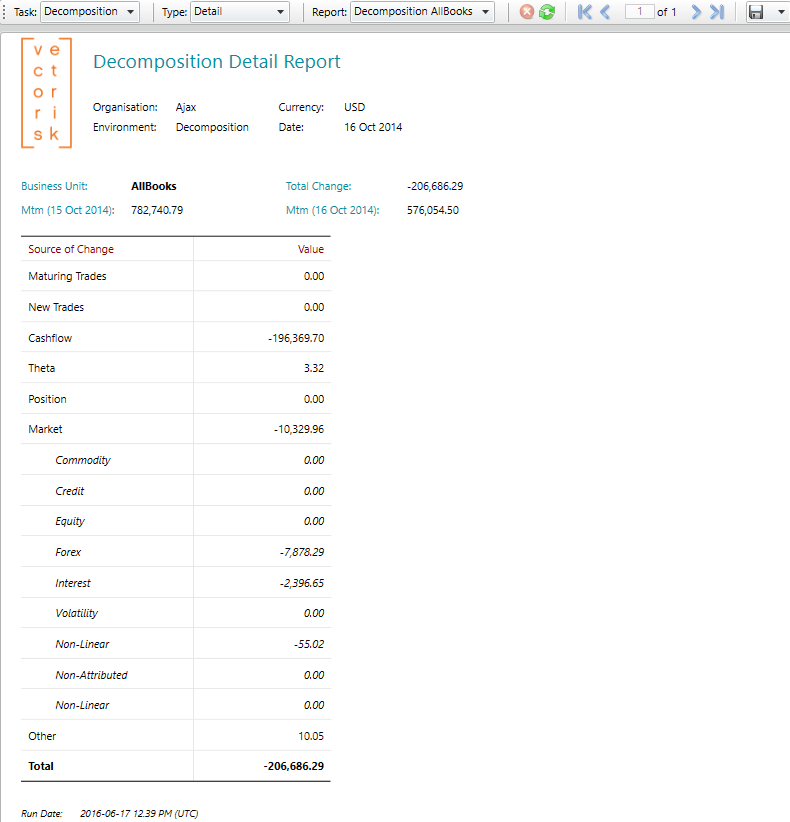

Opening a successful decomposition task from the summary page, a user can select a particular calculation to view its results. Here is a sample result:

Decomposition Report

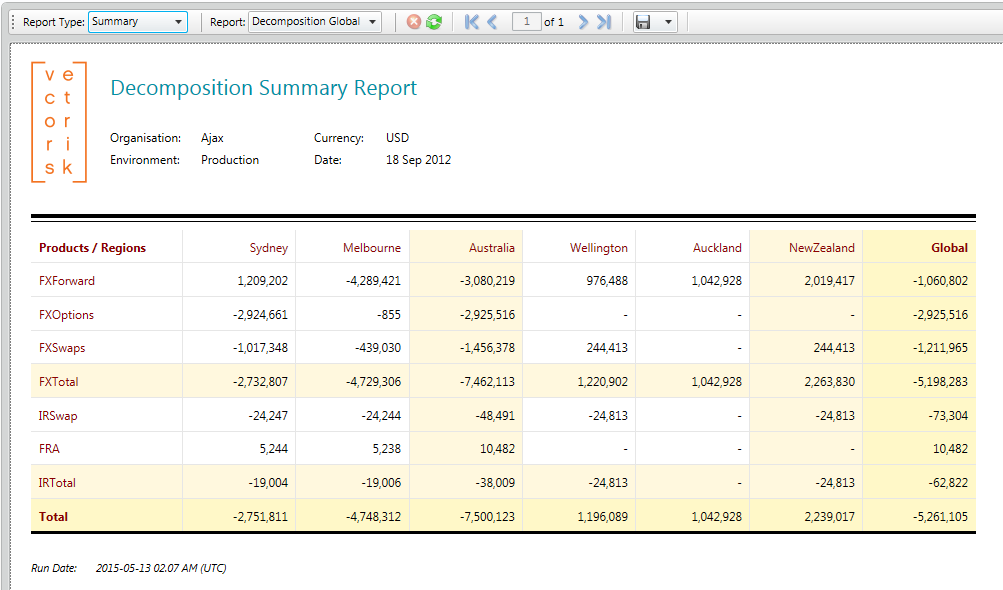

Results can be published to a report. Here is a sample report:

The workflow decomposition task can be defined against a business unit hierarchy. A report (similar to the Var hierarchy report) showing decomposition on each book rolling up to the global result will then be produced by the Publish task.