The Fundamental Review of the Trading Book (FRTB) is the Bank of International Settlements Basel Committee’s response to the Global Financial Crisis (GFC). For banks and institutions with trading books, the Standard Model (otherwise known as FRTB-SA) is a benchmark calculation of market risk against which risk capital will be measured and allocated.

The Standard Model is calculated by analysing all the trades in an institution’s portfolio and assigning them to many risk buckets, attributed by market (equity, interest rate, credit, commodity and FX), risk type (delta, curvature, vega), risk factor (ie curve), currency, industry, and maturity segment.The trades are subjected to the calculation of prescribed sensitivities to these risk factors and then rolled up using Basel supplied risk weights and correlations to produce a measure of the minimum amount of capital that must be held.

The model can be broken into two distinct parts:

- The generation of sensitivities as inputs to the model

- The application of the model to produce the capital result

The Vector Risk implementation of FRTB-SA uses stress testing to generate the sensitivities, but can also accept externally generated sensitivites instead of or alongside the generated ones.

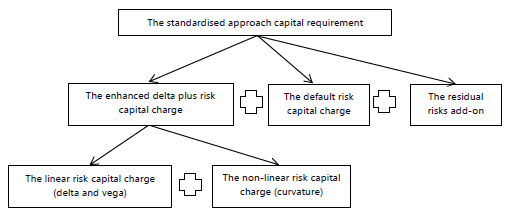

Components of the Standard Model

The standard model is composed of several sub-calculations.

Reference

For the full FRTB specification from Basel please refer to the following document:

www.bis.org/bcbs/publ/d352.pdf