The main distinction between BulkVaR and regular VaR is in the definition by which trades are grouped. Regular VaR uses a business unit hierarchy to calculate VaR at book, desk, and aggregate levels. Whereas BulkVaR uses "categories" defined in the VarDefinition config, which group trades based on combinations of "attributes" which are supplied in the trade load.

For example, trades might be loaded with a list of three attributes (Account, Instrument and Maturity). A BulkVaR calculation can be configured to return a VaR result for each Account, or each unique combination of Account, Instrument and Maturity. Other combinations (eg total VaR by Instrument) can also be generated. As described above, this all gets done in a single call to the risk engine.

For a description of the VaR and Expected Shortfall risk measures please see the VaR page in the Analytic Reference.

Configuration

The configuration files that affect Bulk Value At Risk (BulkVar) calculations are:

| Configuration File | Details |

| TaskList | The BulkMarketVar task type is used to run BulkVar calculations. |

| Assumptions | Base assumptions common to all calculations. |

| VarDefinitions | Classic VaR settings (confidence, horizon and attributions) plus the choice of methodology (historic simulation or monte carlo) and associated settings such as the number of historic or random scenarios respectively. |

| BulkVarCalculations | A calculation specifies a task name, VarDefinition and trancheSize. The trancheSize is usually set to zero (meaning disabled) but can be set to another number in order to force the system to split the calculation into multiple calls to the risk engine. Tranches are created in whole "books". Each trade has a book parameter. If you are using trancheSize, a trade's book can be set to the same value as its Account, or can be customized to work with other category combinations. |

Note: Expected shortfall (ES) is a very close relative of Var, and its configuration is identical. So this section applies equally to Var and ES.

In order to run a BulkVar calculation we need to do the following:

- Create a BulkMarketVar task in the task list.

- Create a VarDefinition (see detailed description below) and assign it with id=1.

- Create a BulkVarCalculation that associates the calculation with a var definition (id=1), and a BulkVar task.

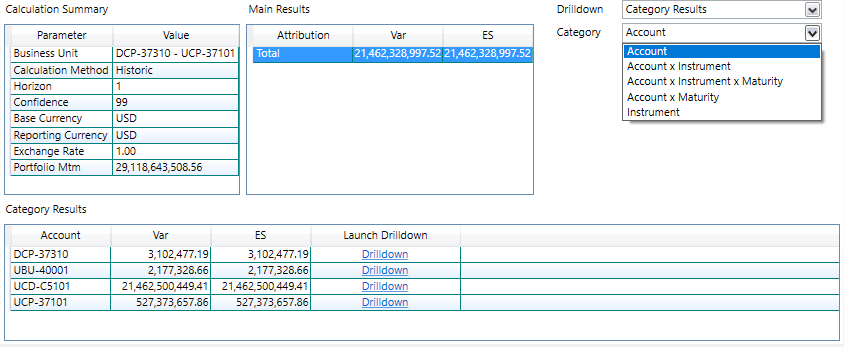

Viewing Results of a BulkVar Calculation

Opening a successful BulkMarketVar task from the summary page, a user can select a particular calculation to view its results. In the sample result below the user is looking at Category Results for Category "Account". The actual VaR and ES results are shown in the lower grid, along with a link to launch a regular VaR viewer for a particular result which is useful for further drilldown and investigation. For other drilldown choices please refer to the regular VaR calculation.

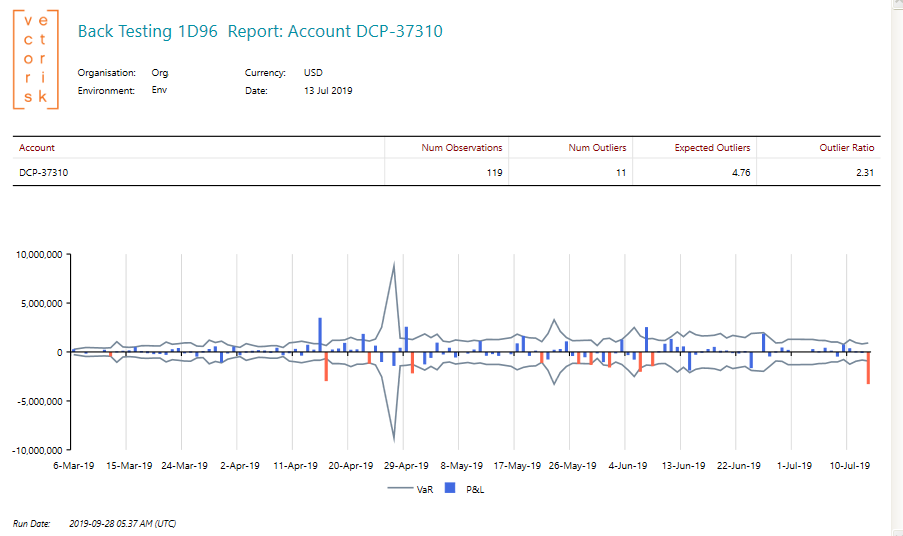

BulkBacktesting

Backtesting involves measuring the theoretical P&L based purely on actual market rate moves, and comparing this to the Var we calculated on the previous day. The backtesting result can be larger than the Var result, but this should only happen occasionally in proportion to the confidence interval chosen for Var. For example if the confidence interval is set at 99% one would expect the backtesting result to exceed Var only once in every 100 days.

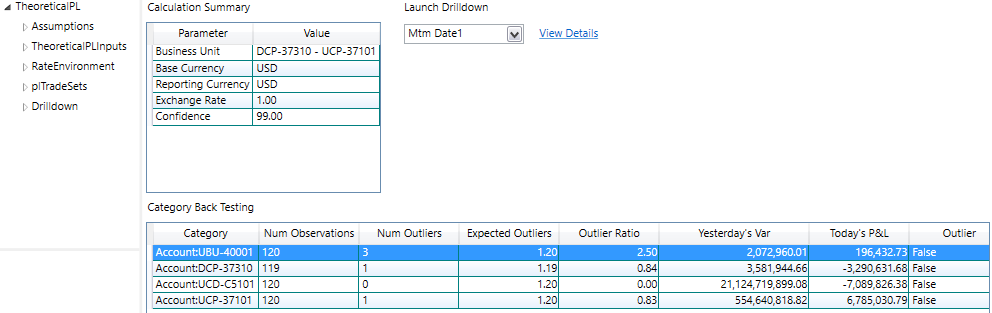

The BulkBacktesting task type is paired up against a BulkVaR task. You can specify which categories the task performs back testing on. For example, the bulk VaR calculation might be performed at "Account" level as well as "Account/Instrument/Maturity" level (see description of BulkVaR above), but the BulkBacktesting task might be configured to only perform back testing at the Account level.

The configuration files that affect BulkBacktesting calculations are:

| Configuration File | Details |

| TaskList | The BulkBacktesting task type is used. In the task list the BulkBacktesting task must have a dependency on a BulkVaR task. |

| Assumptions | Base assumptions common to all calculations. |

| BulkBackTesting Definitions | Specifies the number of days of results to collate into a Backtesting report (see example report below). Also lists the categories (attribute combinations) that are included in the back testing calculation. |

| BulkBackTestingCalculations | A calculation specifies a task name, and trancheSize. The trancheSize should match the BulkMarketVaR task it is performing back testing on. |

Viewing Results of a BulkBacktesting Calculation

Opening a successful BulkBacktesting task from the summary page, a user can select a particular calculation to view its results. In addition, you can click hyperlinks to the MTM calculations on the two dates that are used to calculate the theoretical P&L (change in portfolio value due to overnight rate changes) which forms the basis of the back test.

BulkBacktesting Report