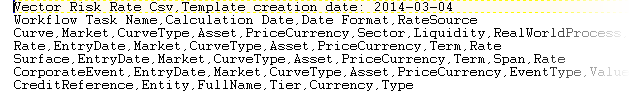

The rate header file has this format:

The file contains headers for curves, rates, surfaces, corporate events (dividends and stock splits), and credit references.

Loading Rates in the GUI

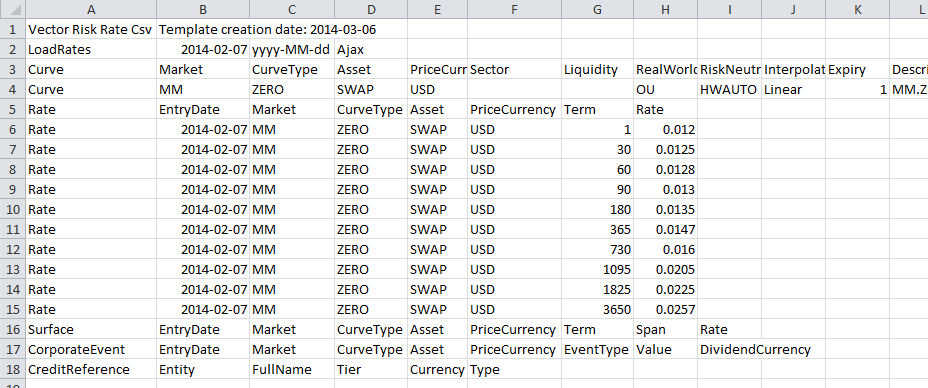

Lets say you want to load some FX trades. Having extracted the curve and rate headers into a spreadsheet here is what your data should look like:

If you are adding private rates against a curve definition that already exists in the system you do not need to include the curve rows in your load file. The rate inspect view allows you to see what rates are available in the system for each of the rate sources that your organisation has access to.

Now save the spreadsheet as a CSV file and follow the instructions described above for loading trades.

Loading Surface Parameters and Correlations in the GUI

Vector Risk supplies the parameters required by Monte Carlo simulation for all of the rate sources it manages. There are two cases where you may need to supply additional paramters:

- You are loading private rates for curves not supplied by Vector Risk.

- You wish to load your own process parameters for curves that are supplied by Vector Risk because you have a certain view on the volatility, correlation or mean reversion of certain curves that you wish the Monte Carlo simulation to abide by.

Note: If you supply rate history there is an alternative to loading the surface parameters and correlations. That is, to use Vector Risk to calculate them. Tasks can be assigned to your environment to recalculate parameters from your own history sets. These parameter recalculation tasks can be scheduled to run daily, weekly or monthly.

Loading Corporate Events

Corporate events are actions that affect the published value of a market rate but do not affect the underlying value. in particular we support stock splits and dividends. Where these events occur in historic series we need to adjust for them to avoid applying incorrect shifts in our historic simulation or paramater estimation. If a market rate has jumped for another reason you can use EventType=other to exclude the jump on this day from the simulation.

Loading Credit References

Credit references are used in CVA calculations to match the counterparty to the most appropriate credit premium. Credit references may be name specific (the name of a legal entity) or a proxy to cover cases where there is no counterparty specific premium available. Proxies may simply be a rating, or may be a rating and sector combination (eg AA_Financial). Credit references also conform to a tier structure where the tier may be one of the following values:

- SENIOR_UNSECURED

- SUBORDINATED

Recovery rates are defined in terms of this tier (typically 40% for senior unsecured and 20% for subordinated). The CVA calculation uses the tier to decide which recovery rate to use).

Note: The recovery rates are loaded as curves in the system so name specific recovery rates may be used if available.