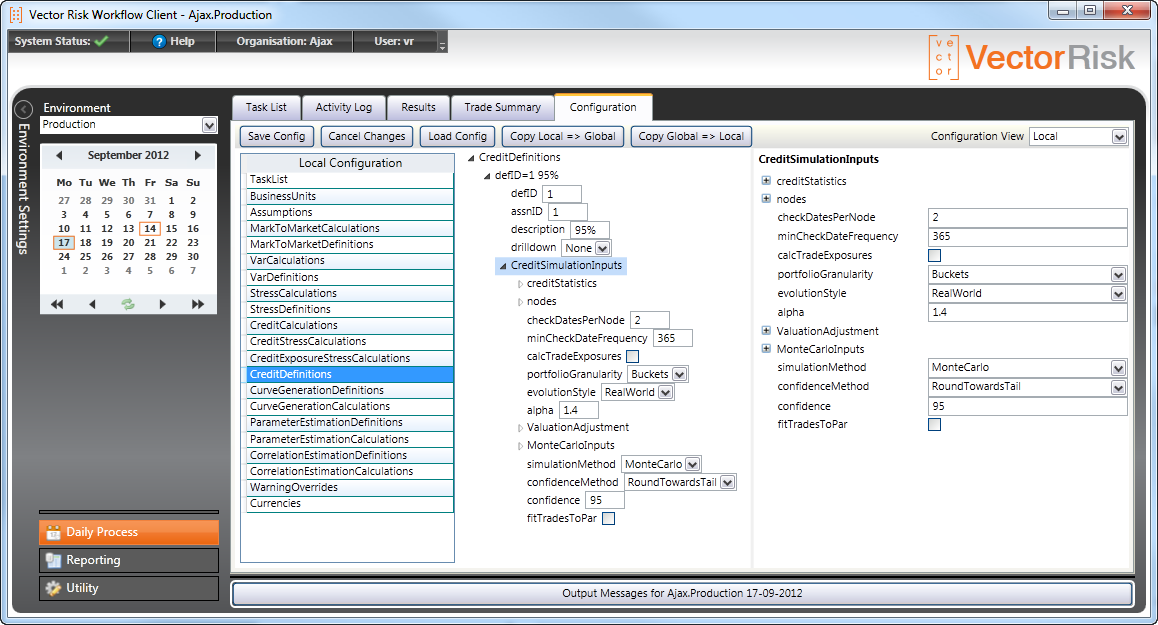

The screenshot beolw shows some of the details of a "credit definition"; the configuration behind a credit calculation. All configuration files have a nested xml structure so in the GUI elements can be expanded or collapsed allowing easy navigation.

Tailoring the System to an Organisation

Configuration is organisation specific including the workflow task list. The initial settings are copied from a template and then modified to suit the requirements of the organisation. It is possible to set up multiple definitions and run any number of calculations.

Local and Global Configuration

Configuration files in the system are replicated each day. So when you choose a particular date on the calendar you see the configuration, load data and calculation results specific to that date. If a change is made to one of the configuraiton files the change will only apply to that date.

By hitting the button "Copy Local => Global" Vector Risk personnel can save the changes to the master configuration and it will then be applied to future dates. This means the configuration of past dates is not affected, and users can return to those dates to view the configuration (and results) that existed at that time.

nb: By future dates we mean dates for which no data has yet been loaded, so the system has yet to "create" an entry in the workflow for this environment / date combination.

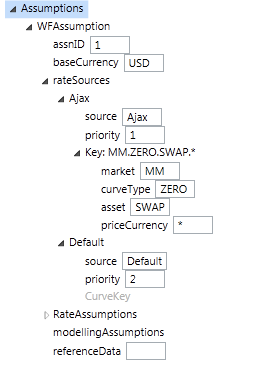

Base Assumptions

All calculations include specific assumptions (such as the credit simulation inputs highlighted in the screen shot above), as well as a reference to a base assumption object. This object contains fundamental settings described below. A customer will usually only have one of these objects and all calculations will use it, but the system does have the capability of supporting multiple base assumption objects.

Base Currency

Risk calculations are performed in the base currency. This means that spot rates must be available in the system to convert all Mtms to the base currency to allow them to be added inside the simulations. Certain cross currency products (such as FX Forwards) have their cashflows converted to the base currency as part of their valuation.

Note: Calculations are defined with their own reporting currency. The translation from base to reporting currency occurs just after a simulation is completed and uses the spot base/reporting exchange rate.

Rate Sources

The Vector Risk service supports multiple rate sources. So you may subscribe to rates already in the system, and supplement these with rates you load yourself. In the Base Assumptions configuration you decide on the priority of these rate sources. The convention is that priority 1 is the higher priority. You can also include Curve Definitions to limit the curves from a given rate source. In the example above swap curves are taken from the 'Ajax' rate source. All other curves and rates are sourced from the 'Default' rate source.

In general you can expect to find most curve definitions defined in the Default rate source. Third party rates and zero curves derived from them are listed in the sectionRate Sources.

A rate source can also be specified at an environment level. This feature is only useful for organisations that have multiple environments in production (for example an accounting firm that uses the system to run audits on its clients). In these circumstances the rate source OrgName.EnvironmentName can be used by a specific environment to allow this extra level of rate separation.

Modelling Assumptions

The system is able to cater for specific modelling assumptions favoured by some but not all clients. Variations in pricing and other risk processes are built into the system and then selected by adding appropriate modelling assumptions into the Assumptions configuration.

Curve Proxies

A customer may wish to cover missing rate data by pointing to a proxy. This can be done either by loading the proxy definitions as part of a load rates task, or by capturing the proxy rule in the Assumptions configuration.

Reference Data

Vector Risk supplies global reference data (calendars, futures dates etc). The customer supplement the global reference data in two ways; either by loading their own private reference data in the GUI, or by specifying bite size pieces of reference data (xml) in the referenceData string in the Assumptions configuration.

Include Today's Cashflows

This boolean flag tells the system whether to include the Mtm of cashflows maturing today or ignore them. If the flag is cleared we are assuming an 'end-of-day' run where the cashflows have run off. If the flag is checked we are assuming a 'beginning-of-day' run where the cashflows have not matured.

Swift Codes

Storage location for organisation's swift codes. This can be left blank unless the sysetem is being used with Swift.