Articles in this section

The FRTB specification is a major overhaul of the Basel 2 or 2.5 market risk regulations. It has many complexities, especially for firms undertaking the internal models approach. As such it deserves its own section in our help guide.

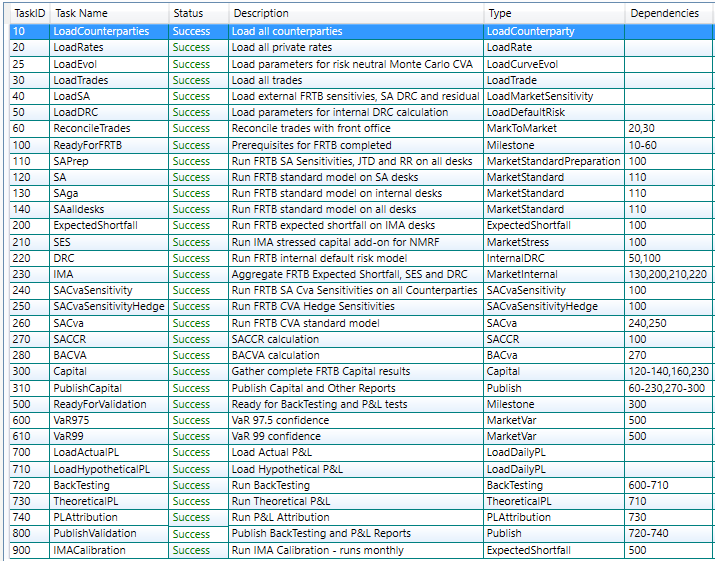

The screenshot below shows a sample workflow for a bank covering both the standardised and internal models approach. The reader should refer back to this screenshot as you read through the following pages describing each of the tasks required to satisfy the regulation. The pages are broken into two sub-sections: standardised and internal, bearing in mind that every bank must run the standardised method on all its desks.

A separate document under the FRTB banner describes the process for measuring market risk on CVA exposures. There are currently two accepted approaches; the standardised approach (SA-Cva) and the basic approach (BA-Cva). Vector Risk supports both of these approaches. They are described in the CVA Capital section.

Use Cases

Depending on the size of the bank and existing system architecture, the Vector Risk FRTB solution can slot into a bank's overall FRTB strategy in a number of different ways.

In a nutshell the system can be the central calculator and aggregator for FRTB or play a lesser strategic role, either as an aggregator of externally derived sensitivities and var vectors, or as a calculation component that exports sensitivities and var vectors for inclusion in a Bank's in-house aggregation process.

The table below lists a number of use cases and the components utilized for each:

| Approach | Calculation | Aggregation | Summary | Component Tasks |

| SBA | Centralised | Centralised | Bank loads all trades and market data to the system which then generates SBA sensitivities and applies the Basel formula to calculate FRTB capital. |

Trade load Rate load SBA sensitivity generation SBA calculation FRTB reporting |

| SBA | De-centralised | Centralised | Bank loads FRTB sensitivities to the system which apples the Basel formula to calculate FRTB capital. | SBA sensitivity load SBA calculation FRTB reporting |

| SBA | Mixed | Centralised | Bank loads FRTB sensitivities for some part of the portfolio and trade data for the rest. The system calculates FRTB sensitivities on the trades supplied, blends these with the loaded sensitivities, and then applies the Basel formula to calculate FRTB capital. (*) | Trade load Rate load SBA sensitivity load SBA sensitivity generation SBA calculation FRTB reporting |

| SBA | Centralised | De-centralised | Bank loads trade and market data for a subset of the portfolio. The system calculates the relevant FRTB sensitivities and exports them. | Trade load Rate load SBA sensitivity generation SBA sensitivity export |

| IMA | Centralised |

Centralised | Bank loads all trades and market data to the system which then calculates expected shortfall vectors and applies the Basel IMA formula to calculate FRTB capital. |

Trade load Rate load (historic + today) Var vector generation IMA calculation FRTB reporting |

| IMA | De-centralised |

Centralised |

Bank loads var vectors (2) to the system which applies the Basel IMA formula to calculate FRTB capital. |

Var vector load IMA calculation FRTB reporting |

| IMA | Mixed | Centralised | Bank loads var vectors for some part of the portfolio and trade data for the rest. The system calculates var vectors on the trades supplied, blends these with the loaded var vectors, and then applies the Basel IMA formula to calculate FRTB capital. (1) | Trade load Rate load (historic + today) Var vector load Var vector generation IMA calculation FRTB reporting |

| IMA | Centralised | De-centralised | Bank loads trade and market data for a subset of the portfolio. The system calculates the relevant var vectors and exports them. |

Trade load Rate load Var vector generation Var vector export |

| SBA + IMA | Any | Any | All of the component tasks are available to any given workflow, which means any combination of the above use cases is feasible. | Trade load Rate load (historic + today) SBA sensitivity load SBA sensitivity generation SBA calculation Var vector load Var vector generation IMA calculation FRTB reporting |

(1) The system actually caters for one additional form of input; trade level delta/gamma values. These are really forms of traditional "greeks" that can be passed into the FRTB sensitivity creation functions to generate true FRTB delta/vega/curvature sensitivities or var vectors. Non-linear trades can also be described as two dimensional conditional loss matrices which are also fully supported in the FRTB sensitivity and var vector generation functions.

(2) Var vectors are the underlying scenario mark-to-markets that are used to calculate expected shortfall (ES).