Articles in this section

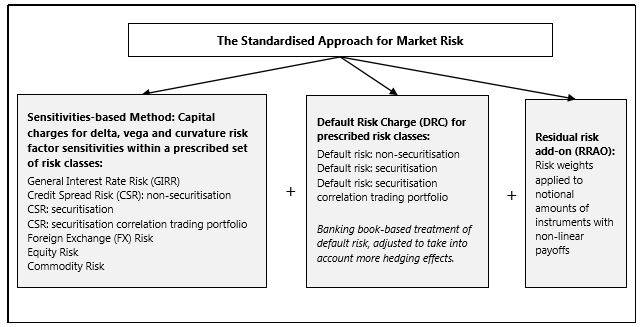

The FRTB standardised approach must be run on each desk in the trading book. The major components of the model are described below:

The calculation can be split cleanly into two parts;

1) Generation of sensitivities and extraction of trade and credit parameters required for default and residual risk.

2) Application of the Basel formulas to roll up the sensitivities, default and residual inputs into a final capital figure.

The first part can be calculated in the front office, or calculated in the risk system.

Vector Risk supports both approaches by providing three different task types for the workflow.

Approach 1: Front Office Sensitivities

This approach combines a "Sensitivity Load" task with a "Standard Model" (roll-up) task.

Approach 2: Risk Engine Sensitivities

This approach combines a "Sensitivity Generation" task with a "Standard Model" (roll-up) task.

The user can even combine both approaches; loading sensitivities for some portfolios or risk classes, and using the Vector Risk analytics to generate sensitivities for others. The sample task list on the "FRTB" page shows all three tasks.

Each of the three task types are explained in detail in the next three pages.

Note: For a general overview of the standardised approach please see the section "Standardised Approach" in the Analytic Reference.