Configuration

The configuration files that affect Market Standard calculations are:

| Configuration File | Details |

| TaskList | Inputs for the MarketStandard task can be loaded from an external source with the LoadMarketSensitivity task or can be generated with a MarketStandardPreparation task. The MarketStandard task is then used to run the FRTB market standard calculations to produce a capital measure. |

| Assumptions | Base assumptions common to all calculations. |

| BusinessUnits | The books that trades are attached to are organised into desks for calls to the risk engine. A hierarchy defines the relationships required to aggregate desk results up to intermediate and total levels. |

| MarketStandardDefinitions | For future use. Required file but currently contains no settings. The existence of this file matches the pattern across all analytics in the system. |

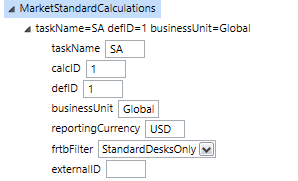

| MarketStandardCalculations | A calculation specifies a task name, business unit, reporting currency and MarketStandardDefinition. Results are generated for each calculation specified. The "frtbFilter" dropdown can be set to run standard desks only, IMA desks only (for required SA equivalent capital on IMA desks), or all desks together. |

In order to run a MarketStandard calculation we need to do the following:

- Create a MarketStandard task in the task list with dependency on a "LoadMarketSensitivity" task, or a "MarketStandardPreparation" task, or both.

- Create a MarketStandardDefinition and assign it with id=1.

- Create a MarketStandardCalculation that links a business unit (desk or "grid hierarchy") with our definition (id=1), and is assigned to our task.

Market Standard Calculation

The example calculation entry below shows a calculation to be the linkage between a business unit, a task and a MarketStandard definition. These elements combine to allow calculations to be run by the system.

Viewing Results of a MarketStandard Calculation

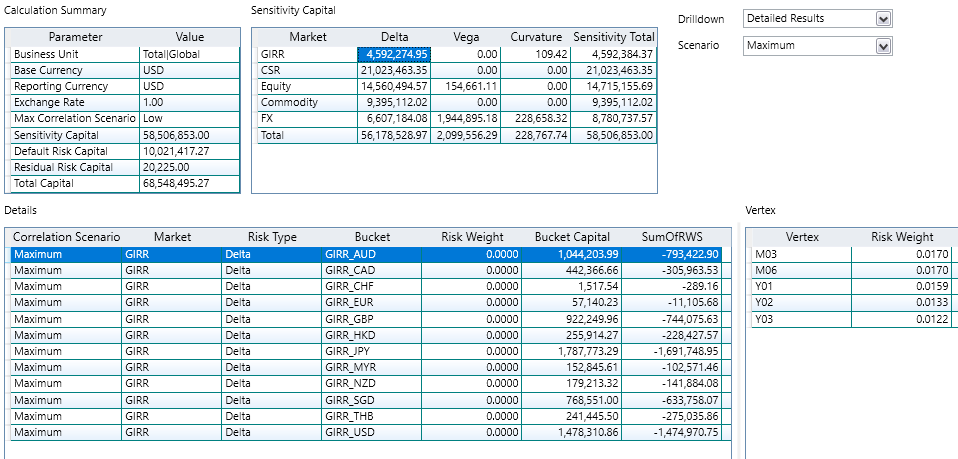

Opening a successful MarketStandard task from the summary page, a user can select a particular calculation to view its results. Here is a sample result:

The highlighted cell shows the market risk capital calculated for GIRR Delta (across all currencies). This table contains 15 such cells: Delta, Vega and Curvature across the 5 markets (GIRR, CSR, Equity, Commodity, FX). The table also shows subtotals and the total sensitivity capital value. The calculation summary shows the Correlation Scenario that produced the maximum sensitivity capital, and adds the default risk and residual risk capital to produce a total SBA capital figure.

Business Unit Hierarchy

The business unit configuration file contains three types of object:

Books

These are the lowest level trading books. Every trade that is loaded to the system has a 'book' attribute that must match one of the books in the business units configuration file.

Desks

These are simple roll-ups of books to a level representing the desk level for the purposes of FRTB. Nb: If a book already represents a whole desk there is no obligation to create a roll-up (of one book). The book can be used directly to represent a desk in the Grid Hierarchy below.

Grid Hierarchies

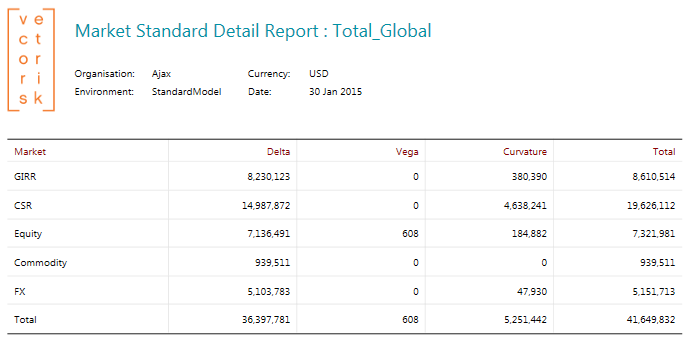

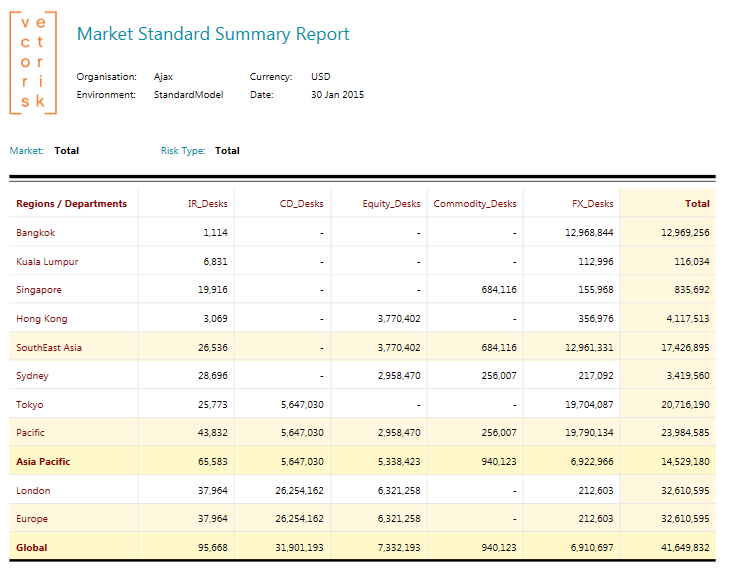

This structure defines the grid elements (desks) and roll-ups (intermediate and total) for a MarketStandard report. Refer to the sample below. The lowest level (grid elements) must come from the book and desk lists. They are given X and Y co-ordinates in the grid report. Roll-ups are then defined via parent linkages on the X and Y axis. The end result is a MarketStandard grid report like the one shown below.

It is also possible to see the breakdown of capital across the standard model vertices for any book or higher level business unit. So any cell from the above report can be expanded in the report below: