This task type caters for banks that calculate sensitivities for the FRTB standardised approach in their front office, and load them to Vector Risk to run the Basel capital formula.

For banks that wish to load trade and position data and use Vector Risk to generate the sensitivities see the section labeled Sensitivity Generation.

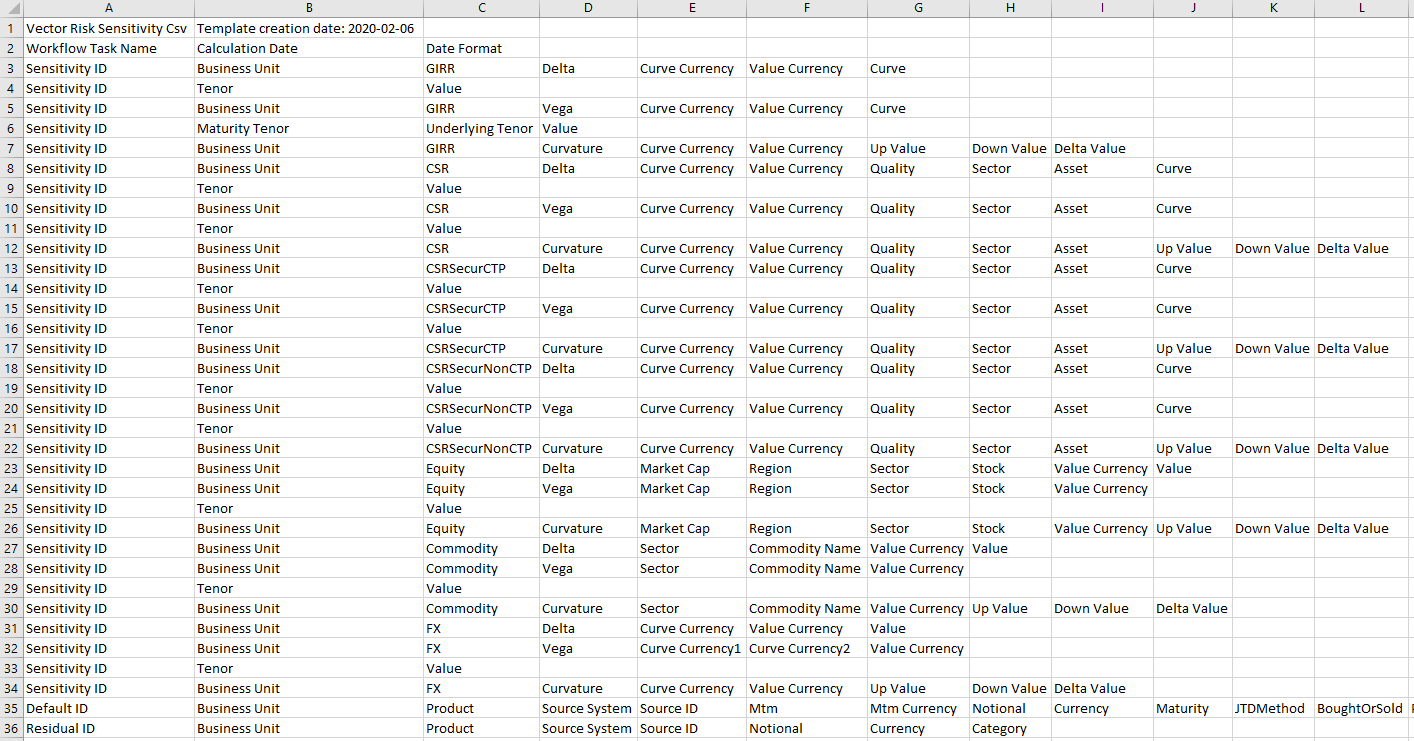

A csv Header file (shown below) can be exported which provides the load format. Instructions for exporting the header file are in the section Loading CSV data. Each risk class has its own three sensitivity formats (for delta, vega and curvature) that match definitions of vertices for that risk class and sensitivity type.

There header file also includes headers for loading SA-FRTB default risk and residual risk.

| Risk Class | Field |

Allowed Values or Description |

| General | Sensitivity ID Curve Currency Value Currency |

Unique integer to link a header row with bucket or tenor rows Underlying currency for the sensitivity Currency of the amounts in 'Value' fields |

| GIRR | Curve Tenor |

Descriptor for the curve (eg AUD_6M_OI) M03,M06,Y01,Y02,Y03,Y05,Y10,Y15,Y20,Y30,Inflation |

| CSR | Sector Quality Asset Curve Tenor |

Sovereigns, LocalGovernment, Financials, BasicMaterials, ConsumerGoods, Technology, HealthCare, CoveredBonds, Other InvestmentGrade, HighYield Credit reference (eg a bond ISIN) Descriptor for the curve (eg a bond zero curve or spread) M06,Y01,Y03,Y05,Y10 |

| CSR Secur Corr | Sector Quality Asset Curve Tenor |

Sovereigns, LocalGovernment, Financials, BasicMaterials, ConsumerGoods, Technology, HealthCare, CoveredBonds, Other InvestmentGrade, HighYield Credit reference (eg a bond ISIN) Descriptor for the curve (eg a bond zero curve or spread) M06,Y01,Y03,Y05,Y10 |

| CSR Secur Non Corr | Sector Quality Asset Curve Tenor |

RMBSPrime, RMBSMidPrime, RMBSSubPrime, CMBS, ABSStudentLoans, ABSCreditCards, ABSAuto, CLONonCorrelation, Other InvestmentGradeSenior, InvestmentGradeNonSenior, HighYield Credit reference (eg a bond ISIN) Descriptor for the curve (eg a bond zero curve or spread) M06,Y01,Y03,Y05,Y10 |

| Equity | Sector Market Cap Region Stock |

Consumer, Telecommunications, BasicMaterials, Financials, Other Large, Small Advanced, Emerging Descriptor for the stock |

| Commodity | Sector Commodity |

EnergySolid, EnergyLiquid, Electricity, Freight, BaseMetals, NaturalGas, PreciousMetals, GrainsAndOilseed, LivestockAndDairy, SoftsAndOtherAgriculturals, Other Descriptor for the commodity |

| FX | CurveCurrency1 CurveCurrency2 |

1st currency of a currency pair for FX Vega 2nd currency of a currency pair for FX Vega |

| Default Risk | Product Obligor Mtm Mtm Currency Notional Currency Maturity JtdMethod BoughtOrSold PutOrCall Strike Amount Rating Seniority Bucket |

Product Obligor for the trade Mtm amount (current value) Currency of the Mtm Notional Amount Currency of the notional Maturity of the exposure CDS, Bond, BondOption, Equity, EquityOption Bought, Sold Put, Call (applies to options) Strike amount on a bond option (sold put) AAA, AA, A, BBB, BB, B, CCC, Unrated, Defaulted Covered, Senior, Subordinate, Equity Corporate, Sovereign, LocalGovernment |

| Residual Risk | Notional Currency Category |

Notional value for the trade Currency of the notional Exotic, ExoticUnderlying |