The configuration files that affect "Market Standard Preparation" calculations are:

| Configuration File | Details |

| TaskList | The MarketStandardPreparation task type is used. |

| Assumptions | Base assumptions common to all calculations. |

| BusinessUnits | The books that trades are attached to are organised into desks for calls to the risk engine. |

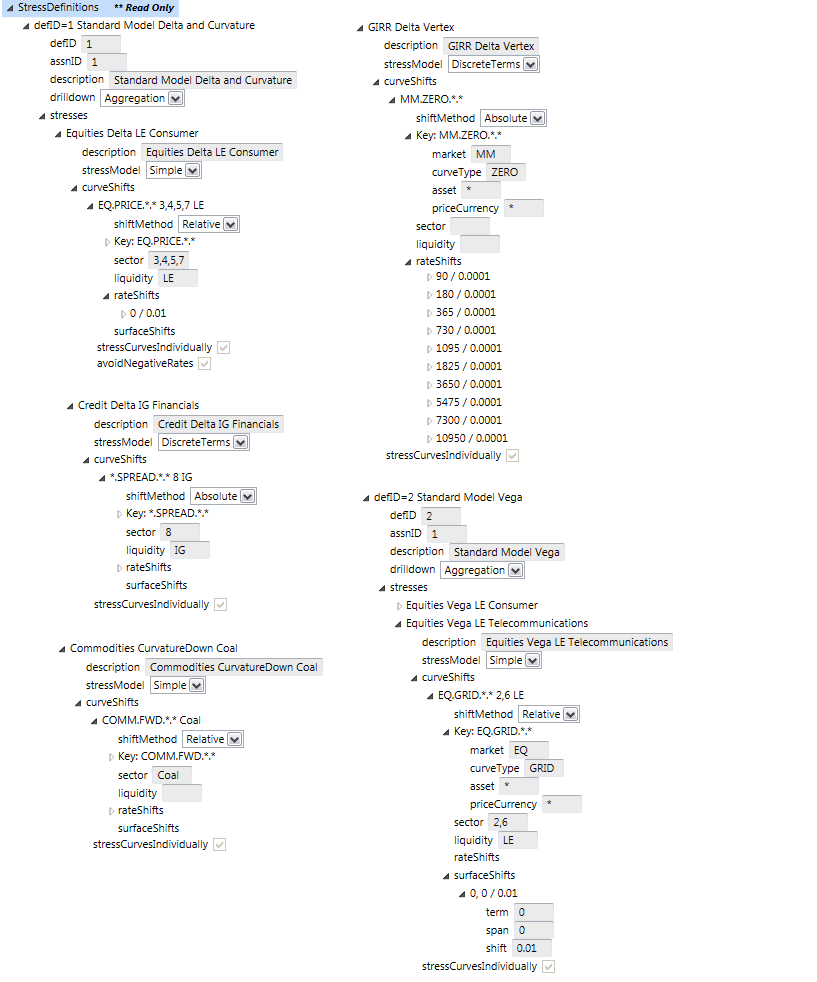

| MarketStandardPerparationDefinitions | The main input is the list of stress definitions for delta, vega and curvature that drive the sensitivity calculations. See examples below. |

| MarketStandardPreparationCalculations | A calculation specifies a task name, business unit, reporting currency and MarketStandardPreparationDefinition. Results are generated for each calculation specified. |

In order to run a MarketStandard calculation for the typical case where Vector Risk generates all of the sensitivity inputs, along with default risk and residual risk inputs we need to do the following:

- Create a MarketStandardPreparation task in the task list.

- Create a MarketStandardPreparationDefinition and assign it with id=1. Ensure delta, vega and curvature stress definitions with the correct base currency are stored in the configuration. Vector Risk supplies these definitions.

- Create a MarketStandardPreparationCalculation that links a business unit (desk or "grid hierarchy") with our definition (id=1), and is assigned to our task.

Stress Definition (to generate MarketStandard inputs)

A significant challenge in the standard model is the generation of the delta/vega/curvature sensitivities that drive the model. Vector Risk runs sophisticated stress tests that are able to determine which trades in the portfolio contribute to which sensitivities by looking at the curves each trade uses in its pricing. The curves in the system are tagged with "sector" and "liquidity" values that correspond to the buckets defined in the model.

The full extent off the XML housing these stress tests is too large to show in the help however the examples below show selected tests expanded such that someone who has read the standard model specification should be able to understand how it is implemented by Vector Risk:

Viewing Results of a MarketStandardPreparation Calculation

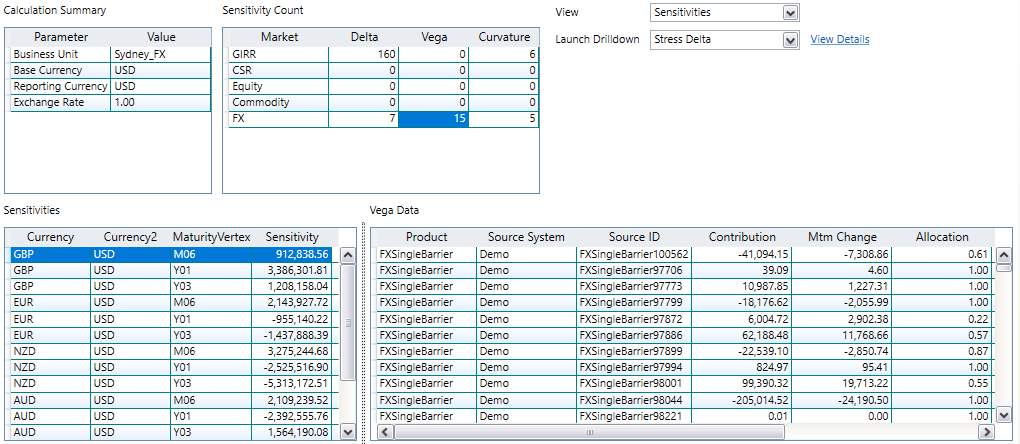

Opening a successful MarketStandardPreparation task from the summary page, a user can select a particular calculation to view its results. Here is a sample result:

The highlighted cell in the "Sensitivity Count" table shows the sensitivity count for a particular class of sensitivities, in this case FX vega. The tables below show the details for the selected sensitivity type. In the case of vega, there is a further breakdown by trade to show how trades of different maturities have been allocated across buckets.

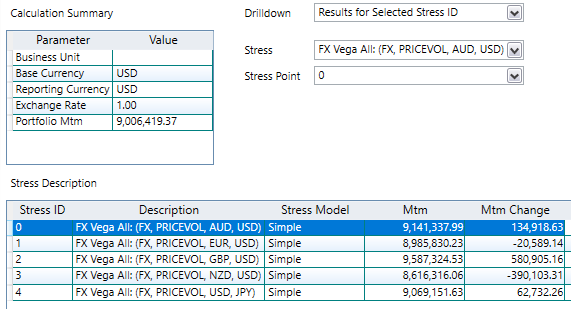

The "Launch drilldown" dropdown allows the user to open views of the underlying delta, vega or curvature sensitivity calculations. Here is a sample view that corresponds to the vega results above: