The default risk charge (DRC) is a component of IMA to capture the default risk of credit and equity trading book exposures.

Summary

1) The first step is the calculation of net jump-to-default (JTD) positions for each obligor. The measurement of JTD is specified in the standardised approach and can be re-used in the IMA calculation.

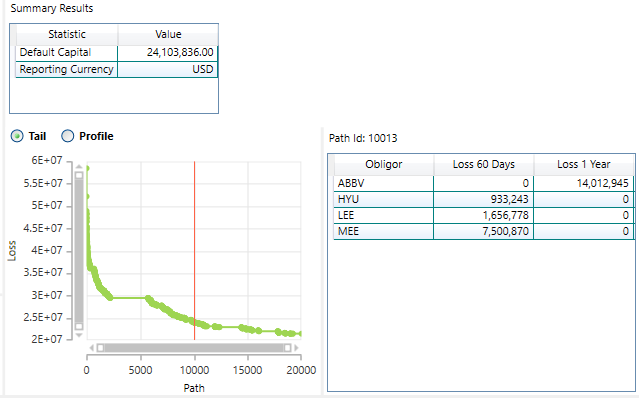

2) Each obligor is modelled by its return based on three factors: country, industry and obligor specific. The second step is a Monte Carlo simulation with around 10 million paths running over a 1 year horizon based on the factors and the correlations between them. We determine the level which corresponds to obligor default based on its probability of default (PD). We then assign default or not for each obligor under each scenario and thus determine the overall loss for each scenario. These are then sorted and the one-tailed 99.9% worst case is chosen as the IMA DRC capital.

Details

The bank must supply relevant trade inputs to calculate jump-to-default (JTD) values. These can be supplied directly, or the bank can supply trade details and credit reference data, and the system will extract the relevant JTD inputs.

Where trade data is supplied, JTD is calculated at individual trade level before offsets are applied to find the obligor level JTD. The system also support the use of pricing grids or delta/gamma sensitivities in lieu of trades.

JTD methodologies have been implemented for CDS, Bonds, Equities, Bond Options, Equity Options. The JTD for other instruments (for example credit indices or multi-underlying instruments) must be calculated by the customer and loaded to the system.

The system can accept a mixture of trades, trade sensitivities and pre-calculated JTD information. JTD calculated from the trades and trade sensitivities will be blended with supplied JTD before commencing the Monte Carlo DRC simulation.

The customer must also supply obligor probability of default (PD) and loss given default (LGD) values, obligor betas to industry and region, mean and volatility for all the obligor and systemic factors, default correlations for obligor pairs and industry/region pairs.

The bank is responsible for modelling the PD, beta, mean, volatility, correlation and LGD input data.

CSV headers can be exported from the system covering all of the model inputs. The system can load data in CSV or XML format, or directly via web service calls from bank systems.

We model two jump-to-default values for each obligor, one with all positions, and one for just the non-equity positions. If the user chooses (via an input flag) a 60 day liquidity horizon for equities, the simulation will model both 60 day and 1 year default events on each path. An obligor can then have three states (“No Default”, “Default within 60 days”, “Default after 60 days”) and the appropriate JTD value is used.

Typically, we configure the system to run 10 million paths in our Monte Carlo for DRC.

The GUI result view shows a graph of the tail of the distribution, along with the obligors defaulting on the path matching the 99.9% confidence interval.