The Internal Models Approach is centered around the calculation of expected shortfall. The Vector Risk solution is able to include pre-processed vectors in its expected shortfall calculations. These vectors can be run on their own to give the entire ES result or blended into simulations with loaded trades to give the overall ES result.

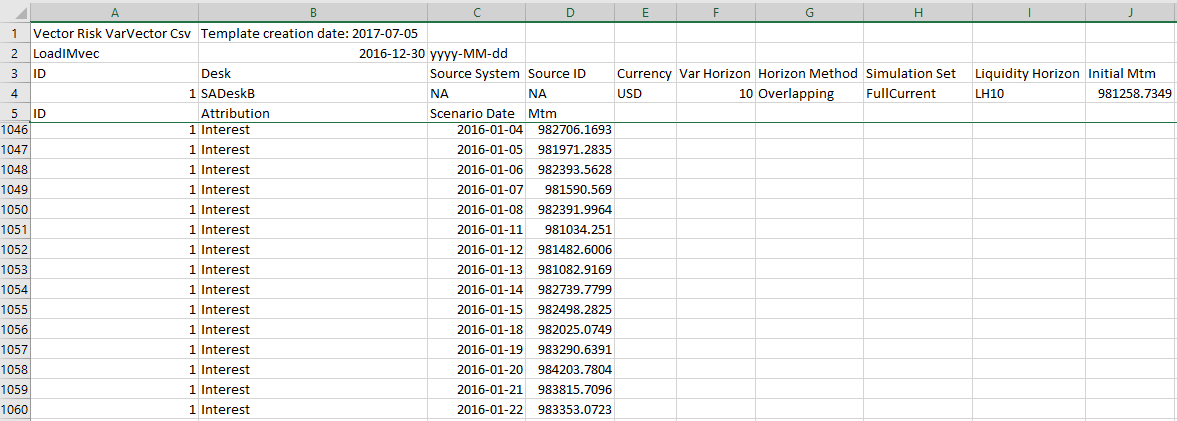

A csv Header file (shown below) can be exported which provides the load format. Instructions for exporting the header file are in the section Loading CSV data.

The pattern of header row and then scenario rows is repeated for each combination of fields in the table below required for IMA.

Note: Var vectors may be loaded at the individual trade level (identified by Source System and Source ID), or at the desk level.

| Field Name | Allowed Values |

| ID | A unique ID in the csv file for this Var Vector. |

| Desk | The desk for this var vector. |

| Source System | (optional) The source system (may be NA). |

| Source ID | (optional) The source ID if this vector represents a single trade (otherwise may be NA). |

| Currency | The currency of the Mtm fields. |

| Var Horizon | Required to be set to 10 for an IMA calculation. |

| Horizon Method | Required to be set to "Overlapping" for an IMA calculation. |

| Simulation Set | "FullCurrent", "ReducedCurent", "ReducedStress". |

| Liquidity Horizon | "LH10", "LH20", "LH40", "LH60", "LH120". |

| Initial Mtm | The Mtm for the unshifted scenario. |

| Attribution | "Commodity","Credit","Equity","FX","Interest","Non-attributed","Total". |

| Scenario Date | The second date in the date pair from which the rate shift for this scenario is sourced. |

| Mtm | The Mtm of the trade or portfolio after applying the rate shifts for this scenario. |