Theoretical P&L must be calculated at the desk level. The calculation involves the risk system valuing the desk's trades using same day and next day rates. The change in value is called "theoretical P&L" as it ignores new trades, trade maturities and trade aging.

The theoretical P&L is compared to the hypothetical P&L (an equivalent calculation performed with the bank's front office trading models) with two tests, together called "P&L Attribution".

Configuration

The configuration files that affect Theoretical P&L calculations are:

| Configuration File | Details |

| TaskList | The TheoreticalPL task type is used to run theoretical P&L calculations. |

| Assumptions | Base assumptions common to all calculations. |

| BusinessUnits | The books that trades are attached to are organised into desks for calls to the risk engine. |

| TheoreticalPLDefinitions | This configuration file contains an optional parameter to define alternative rate sources. This allows alignment of market rates for desks that have their P&L measured in different time zones (to the main time zone used as the base for the risk calculations). |

| TheoreticalPLCalculations | A calculation specifies a task name, business unit (or hierarchy) and TheoreticalPLDefinition. Results are generated for each calculation specified. |

In order to run a TheoreticalPL calculation we need to do the following:

- Create a TheoreticalPL task in the task list.

- Create a TheoreticalPLDefinition and assign it with id=1.

- Create a TheoreticalPLCalculation that links a business unit (desk or "grid hierarchy") with our definition (id=1), and is assigned to our task.

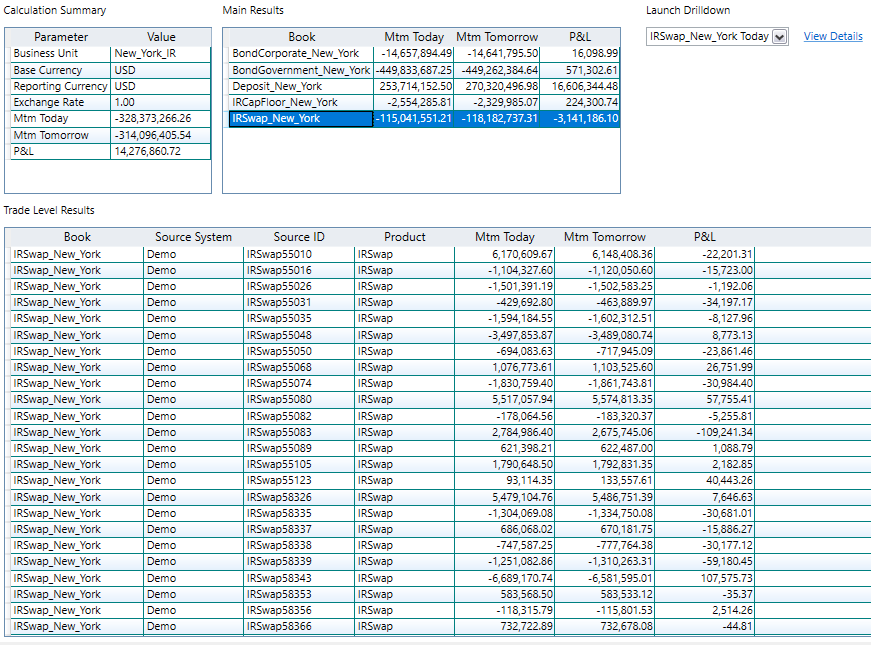

Viewing Results of a TheoreticalPL Calculation

Opening a successful TheoreticalPL task from the summary page, a user can select a particular calculation to view its results. Here is a sample result: