This action is performed with the P&L load task type.

P&L can be loaded at desk or book level, and can be supplemented by trade level data. The reason for this flexibility is to cater for differing capabilities within banks. The pros and cons of loading at the various levels are as follows:

| P&L Granularity | Pros | Cons |

| Book Level | The system's business unit hierarchy will roll-up book P&L to the current or proposed desk structure. Changes in desk structure can be automatically reflected in historic desk level P&L without re-load, allowing the bank an easier path to accreditation of a new desk structure. Allows book level reconciliation of hypothetical and theoretical P&L which is an improvement over desk level reconciliation when trying to diagnose differences. |

May be difficult to diagnose differences between hypothetical and theoretical P&L if trade level P&L is not loaded. |

| Trade Level | Allows for trade level reconciliation, including mark to market differences and trade alignment (trades existing in the P&L system but not the front office load process, or vice versa). |

May require significant project work to create a trade level P&L extract. Adds some operational burden given significant volume of trades. |

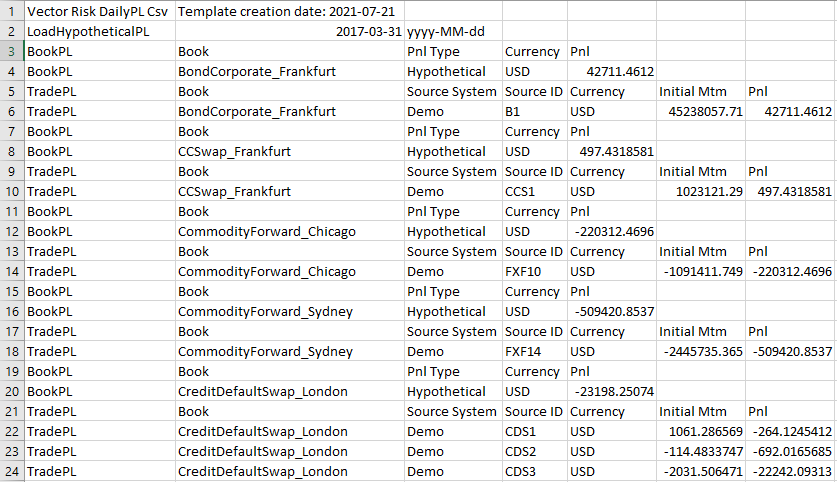

A csv header file can be exported from the load task and used to create an input file such as the one below containing hypothetical P&L data. This sample file includes P&L at desk and trade level.